Foreign investors hold a sizeable share of Vietnam's animal feed market and are investing further to see supply meet demand.

Australian - Vietnamese joint venture the Mavin Group opened its fifth animal feed factory in late May, at the Cai Tau Ha Industrial Zone in the Mekong Delta’s Dong Thap province. The Group’s largest and most-modern factory is expected to bolster its supply capacity in Vietnam’s south and help provide technical support to customers in a comprehensive chain. Despite the domestic pork market crashing last year and leading to a decline in the animal feed business, Mavin has continued to implement its expansion plans in terms of scale and categories.

Mr. David John Whitehead, Chairman of the Mavin Group, said the market difficulties gave it the opportunity to restructure its operations, transforming into a group and subsidiaries. The organizational realignment was a preliminary step towards the Group’s goal of becoming a fully-integrated company encompassing everything from feed and swine genetics all the way up to premium, high-quality, safe, and ready-to-eat food. Mavin saw growth maintained at 30 per cent in 2017, of which animal feed production was the primary contributor.

Supply short of demand

Purchasing power has grown substantially over recent years in Vietnam and dining habits and expectations are changing as a result. Diets, for example, are now more nutritious, Mr. Nguyen Ba Luan, Commercial Manager of Cargill Agriculture & Supply Chain (CASC) in Vietnam, told VET. “There is a greater demand for healthy animal protein,” he said. “The demand for food in Vietnam has substantially shifted from food security to food safety, due to multiple food scandals over the years. So, we see building consumer trust in food safety as an ongoing opportunity to improve our offerings, from both safe ingredients to safe feed, to meet changing consumer needs.”

The local supply of animal feed ingredients - corn or wheat and soybean - falls well short of demand and imports, which increase every year, fill the gap. A report on Vietnam’s feed sector issued by the US Department of Agriculture (USDA) put estimated feed demand at 29.6 million tons in 2018; higher than last year. Local supply is estimated at 11.2 million tons this year, with imports forecast at 16.9 million tons.

Corn production in Vietnam is predicted to fall this year due to poor weather, with imports to rise from 5.7 million tons last year to 7 million tons. “Vietnam imports more than 16 million tons of animal feed ingredients annually, and the figure continues to grow,” Mr. Luan said.

To meet growing demand for grains, primarily in the food and animal feed sectors, Cargill opened its first 80,000 metric ton storage facility in April this year, at the Saigon International Terminals Vietnam port in southern Ba Ria Vung Tau province. “Vietnam is a key market for Cargill and this new storage facility strengthens our ability to supply high-quality feed grains and animal feed products to our customers,” he explained. “This investment is a part of our strategy to expand our business to meet the growing demand for feed grains and animal feed, driven by increased meat consumption among Vietnamese consumers.”

In the past three years the volume of grains and oilseeds handled by Cargill in Vietnam has grown four-fold, from 400,000 metric tons to 1.75 million metric tons. It expects this to increase to more than 3 million metric tons by 2020, making it one of the largest importers, marketers, and distributor of grains in Vietnam.

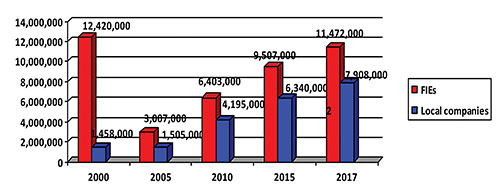

Feed production, 2000-2017

Source: Ministry of Agriculture and Rural Development, 2017

Rising foreign investment

The animal feed industry has maintained double-digit growth over the last two decades, with output jumping from 400,000 tons in 1993 to more than 29.1 million tons in 2017. According to the Department of Livestock Production at the Ministry of Agriculture and Rural Development (MARD), Vietnam is now the leading country in ASEAN and tenth globally in industrial animal feed production. The consumption feed market is estimated at $6 billion and will only continue to grow.

As such, foreign investors in Vietnam have expanded their scale and categories in the last two years. In January, South Korea’s CJ Group opened its fifth animal feed plant in the country and is planning to open its sixth this year. A $15-million plant with annual output of 500,000 tons in northern Hai Duong province, meanwhile, was opened by Singapore’s HAID Group, which has invested in six plants around the country.

Indonesia’s Java Pelletising Factory also invested VND135 billion ($5.97 million) in building its fifth plant in the country, in south-central Binh Dinh province, in 2016, with a monthly capacity of 15,000 tons. Thailand’s CP Group also owns four animal feed plants in Vietnam, with an annual capacity of more than 400,000 tons each. Uni-President from Taiwan, besides owning three plants producing 300,000 tons of fish feed annually, also invested $20 million in building another 100,000-ton capacity plant in central Quang Nam province.

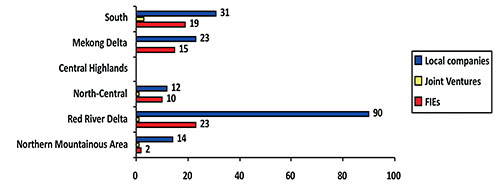

Number of feed factories, by region, 2017

Source: Ministry of Agriculture and Rural Development, 2017

According to MARD’s Animal Husbandry Department, there were 218 animal feed plants in Vietnam in 2017 with an average monthly capacity of 28,200 tons. Of these, 71 are foreign-invested companies, with an average monthly capacity of more than 15,700 tons and holding a market share of some 65 per cent.

Higher foreign direct investment into the country is a positive sign of economic growth and Cargill saw opportunities from the resulting improvements in quality of life. Its large and young population also make it an attractive proposition for businesses. Cargill was the first US company to obtain a distribution license, in 2009. “Like many other MNCs, we will continue to make investments in Vietnam in a number of ways, all aimed at growing our business and serving our customers,” Mr. Luan said. “We will do that through investing in facilities and talent and in the communities in which we operate.”

Positioning itself one of the three largest foreign-invested enterprises, the Mavin Group identified Vietnam as having potential in the feed sector thanks to its weather and soil. “Many foreign investors are arriving in the country and making significant investments in technology and modern production, especially towards a closed chain model,” said Mr. Whitehead. “This is a challenge for us, to continually innovate and build our competitive capacity. At the same time, it is an opportunity to change the market and consumers’ habits, which accept high-quality products in accordance with world standards.”

Though established in Vietnam in 1995, Cargill doesn’t feel in a position to comment on market rankings for established, key foreign-invested players in the local feed industry. “Our customer focus strategy, tremendous efforts to enhance animal nutrition and farm management capabilities for farmers, people development strategies, and commitment to enriching local communities has kept us in a strong position for growth and success,” Mr. Luan said.

Cargill is also investing in helping farmers become more efficient and productive. Vietnam will continue to be a key market, and the company intends to continue its investments. “We are very proud of our record and the growth we have seen in Vietnam, as one of the leading animal nutrition companies in the country, producing fish and shrimp, poultry and swine feed, premix, and additives,” he added.

Mavin expects the animal feed market to be influenced by positive changes in the market as well investments in technology, processes, and the expansion of chains. Mr. Whitehead said the company will continue with efforts this year to complete its value chain and research and develop livestock feed products, for launch at year’s end.

Source: Vietnam Economic Times